Shopping is a necessity, but it can quickly turn into a budget-breaking activity if not done wisely. With endless advertisements, tempting discounts, and new products launching daily, resisting the urge to overspend can sometimes feel impossible. But what if you could shop smarter without sacrificing quality or missing out on the things you need and love?

That’s what this blog is all about. By the end of this article, you’ll learn practical, easy-to-follow strategies to shop well, save money, and enrich your life without draining your wallet. From setting limits to adopting mindful habits, you’ll discover how financial savvy and smart shopping go hand in hand.

The Art of Wallet-Wise Shopping

Shopping wisely doesn’t mean buying the cheapest option or cutting corners. Instead, it’s about making thoughtful decisions and prioritizing what matters most. Here’s why wallet-wise shopping should be on your priority list:

- Financial Health: Spending within your means helps build long-term financial stability.

- Sustainability: Thoughtful purchases reduce waste and promote conscious consumption.

- Stress Reduction: Managing your spending eliminates the anxiety that comes with living paycheck to paycheck.

Now, let’s look at how you can put this into practice.

Step 1 Rethink the Impulse Buy

Impulse purchases are one of the quickest ways to derail your budget. Whether it’s snagging a candy bar at checkout or adding “just one more thing” during an online shopping spree, we’re all guilty of letting impulse take over. But how can you combat it?

Ask Yourself Three Questions

Before you buy, pause and ask:

- Do I truly need this item?

- Will this improve my daily life or serve a long-term purpose?

- Could this wait until a better price or discount comes along?

Nine times out of ten, this moment of reflection will prevent you from buying something unnecessary.

Create a “Want List”

Instead of immediately buying something on a whim, write it down on a “want list.” Revisit this list after a week; often, the urge to purchase will have faded, helping you recognize unnecessary temptations.

Step 2 Budget for Success

Budgeting isn’t boring; it’s empowering. Knowing exactly how much you can spend gives you freedom because you stay in control.

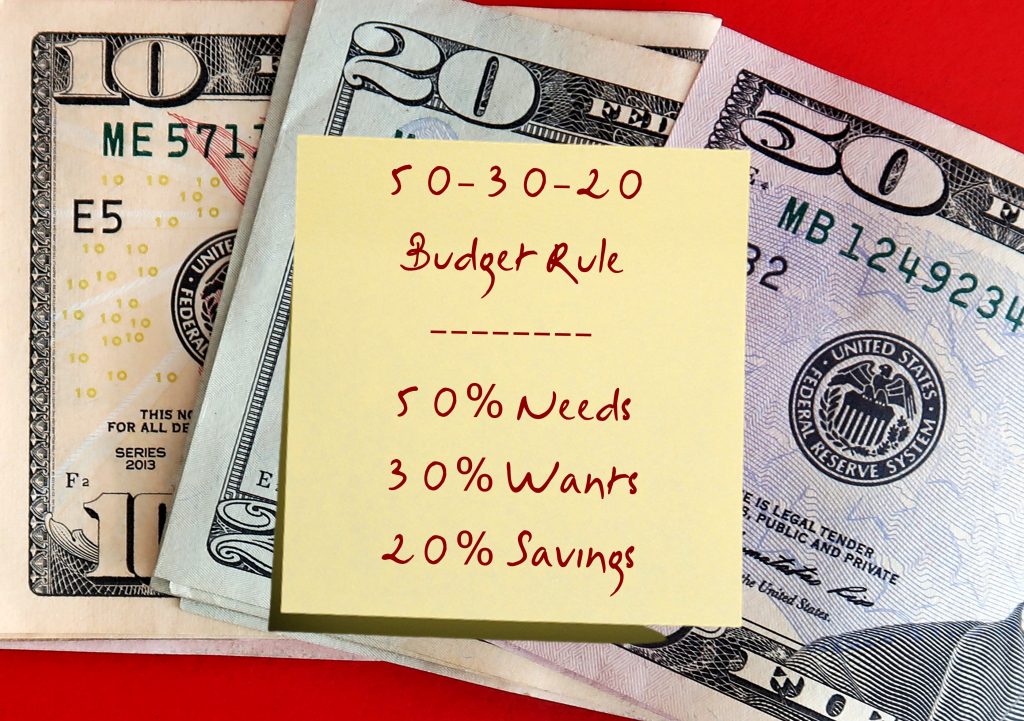

The 50/30/20 Rule

One effective way to budget is by following the 50/30/20 rule:

- 50% of your income covers necessities (rent, groceries, bills).

- 30% is allocated to “wants” (shopping, entertainment, dining out).

- 20% goes toward savings and debt repayment.

This framework ensures there’s room for responsible shopping without risking financial goals.

Set Clear Spending Limits

Having a general budget helps, but breaking down categories further makes a difference. For example, allocate a fixed amount each month for clothing, electronics, and household items. Sticking to these boundaries can prevent overspending on categories prone to splurges.

Step 3 Shop Smart Online and Offline

Whether you’re braving a shopping mall or browsing online, certain strategies can help you make wise choices.

Harness the Power of Discounts and Deals

Coupons, promo codes, and seasonal sales are a shopper’s best friend. Many retailers offer discounts on specific holidays or at the end of seasons. Always compare prices and keep an eye out for deals on products you’ve been eyeing. Websites like RetailMeNot and browser extensions like Honey can automatically find coupons for you.

Take Advantage of Cashback Rewards

Sign up for credit cards or apps that provide cashback on purchases. Apps like Rakuten offer cashback on items you’d be buying anyway.

Be Wary of Free Shipping

Free shipping offers often tempt us into adding unnecessary items to our cart. Avoid falling into the trap of “spending just a little more” to qualify for free delivery. Instead, add shipping costs into your overall budget and only purchase what you need.

Shop Out of Season

Pro-tip? Buy winter coats in summer and swimwear in winter. Shopping out of season typically means deep discounts on quality items.

Step 4 Maximize Subscriptions Mindfully

The subscription economy has grown rapidly, covering everything from streaming entertainment to curated food boxes. Done right, monthly subscriptions can actually save you money. But used poorly, they can drain your finances without adding much value.

Benefits of Monthly Subscriptions

- Convenience: Products delivered to your door for less effort.

- Cost Savings: Quality goods often come cheaper in bundles.

- Simplifies Shopping: No need to waste time hunting for individual items.

How to Avoid Overspending on Subscriptions

- Audit Subscriptions Regularly: Are you still using that streaming service or gym membership? Cancel unused or duplicate subscriptions.

- Set a Limit: Cap yourself at a specific number of active subscriptions.

- Look for Trials and Referral Discounts: Many companies offer free trials or discounts for referrals. Use these to test the value before committing.

Some popular, wallet-wise subscription services include coffee delivery programs, meal kit services like HelloFresh, and personal care packages like those from Dollar Shave Club. These businesses provide high value if you need what they offer, but only subscribe when it aligns with your habits!

Step 5 Practice Minimalism

Minimalism doesn’t mean owning nothing; it’s about intentionally choosing quality over quantity.

Invest in Quality

Sometimes it’s better to spend more upfront for something that will last longer. Well-made products can save you money in the long run compared to replacing cheaper, low-quality items frequently.

For clothing, seek pieces made of durable fabrics like wool or denim. In home goods, opt for reliable brands known for an extended lifespan.

Declutter Before Shopping

Taking inventory of what you already have might surprise you. Decluttering clears space and helps you realize just how many items you already own, preventing duplicate purchases.

Step 6 Cultivate a Wallet Wise Mindset

Long-term success comes from adopting smart financial habits as part of your lifestyle.

Avoid Emotional Spending

Shopping to cure boredom, stress, or sadness often leads to buyer’s remorse. Instead of turning to retail therapy, find alternatives like journaling, exercising, or connecting with friends.

Educate Yourself Financially

The more you know about personal finance, the better decisions you’ll make. Read blogs, listen to finance podcasts, and stay informed. Knowledge is power!

Surround Yourself with Like-Minded People

Join communities or groups focused on budgeting and smart spending. Interacting with others who share these goals will keep you motivated and accountable.

Make Shopping Smart and Fun

Budgeting and shopping wisely don’t have to suck the joy out of life. Instead, they can enrich it! By making intentional choices, you’ll not only improve your financial health but also find more meaningful satisfaction in the things you own.

At the end of the day, it’s not about depriving yourself but about prioritizing what truly matters. Want to get more tips on shopping smart and saving big? Stay tuned to our blog for ongoing advice for exclusive resources and guides.

Happy shopping!